Yale’s endowment earned an average annual return of 11.8% from 1998–2018, outpacing the average return of university endowments during that period by 5%.

What’s the secret to Yale’s success?

As Chief Investment Officer of the Yale Endowment David Swensen told NPR, the endowment’s success centers around diversification, low fees, and flexibility. If you analyze the allocation of Yale’s assets in 2019, you’ll see it goes far beyond traditional stocks and bonds. In fact, 75% of their assets are in alternative investments as of June 30, 2019—notably, natural resources, absolute return funds, leveraged buyouts, and real estate makes up 10% of the fund.

Now, you may think: How can you participate in similar assets as Yale’s model of investing?

While retail investors may not have the funds or capabilities to enter such alternative investments (especially those like leverage buyouts and absolute return funds), investing in real estate has gone “mainstream.” Even non-accredited investors can profit from real estate.

So, the question is: Should you consider investing in real estate?The answer? Yes, based on your financial profile.

Real estate has a lower barrier to entry today

Stocks and bonds have long been favored by retail investors for their liquidity and easy access. You don’t need a massive down payment to invest in stocks.

On the other hand, real estate has traditionally required a lot of paperwork and out-of-pocket money. During the first half of the 20th century, the majority of people were invested in real estate by owning a home (and nothing else). If you wanted to allocate more of your portfolio to real estate, you either had to purchase a real estate-focused stock or buy properties directly, which would have necessitated a lot of work and capital.

With the introduction of real estate investment trusts (REITs) in 1960, the landscape changed. REITs have provided small investors with access to income-producing real estate.

Today, you have more options than ever when it comes to investing in real estate. Most don’t require you to directly own and manage properties. As an article from The Motley Fool notes, you can easily invest in real estate in three ways:

- Through the stock market

- Through real estate crowdfunding

- By partnering with active investors to buy properties

If you want to invest in real estate through the stock market, you can either buy:

- Real estate-focused stocks

- Shares of a real estate investment trust (REIT)

- Shares of a real estate mutual fund or exchange-traded fund (ETF)

In short, investors can access real estate without the need for spending large sums of capital or actively managing properties. It’s now easier than ever to invest in real estate.

Real estate delivers upside potential

Owning a home is a part of the American Dream.You’ve definitely heard that before. It’s why real estate is the most common and most trusted alternative investment.

That’s because home ownership has historically provided Americans with stability and opportunities for building wealth. As reported by the Knowing this, it may make sense for an individual’s portfolio to include real estate investments. Yale’s David Swensen advises the average investor to dedicate 15% of their portfolio to real estate.

So, why exactly may real estate be such a good investment?

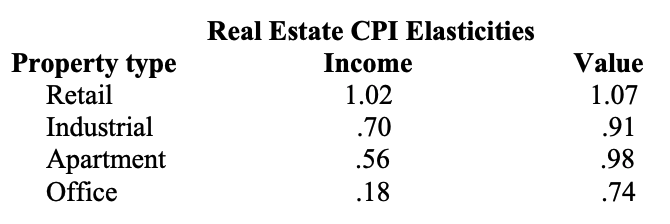

In our opinion, real estate offers a hedge against unexpected inflation without sacrificing expected returns. A study by MIT shows the correlation between the consumer price index* and property investments. In terms of income from real estate investments, retail, industrial, and apartment properties provide a hedge or partial hedge against inflation:

*Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urbanconsumers for a market basket of consumer goods and services

Real estate values have historically increased steadily over time in many markets. In hot markets (such as San Francisco and New York), real estate values have risen dramatically in the 2010s, making investors and homeowners much wealthier.

Finally, real estate could be less volatile than the stock market. Measurements of standard deviation (which calculate the volatility of an asset) show that multiple types of real estate investments have less volatility than stock investments over different periods of time.

*The data shown represents past performance, which is not a guarantee of future results.

Making real estate a part of your portfolio

As far as alternative investments go, real estate may be a worthy option. It’s not only a tangible, accessible asset that most investors understand; it also offers great risk-return tradeoff.

Generally uncorrelated to stock market swings, real estate typically doesn’t suffer from cyclical ups and downs. As a less volatile asset, real estate could deliver upside potential even during economic downturns. Real estate has also proven historically to be a good hedge against unexpected inflation.

Although real estate is an illiquid investment compared to the liquidity of the stock market, the long-term cash flow could provide an alternative source of passive income and capital appreciation.

Since real estate isn't as liquid, you can't rely on selling your properties immediately when you may be in need. Other disadvantages include the costs associated with property management and the investment of time that goes into repairs and maintenanceAny investor should consider investing in real estate. To determine if real estate investing is right for you, talk with an investment professional. They’ll take the time to understand your investment needs, individual goals, and risk profile. They’ll help you decide whether you should invest in real estate (and, if you decide to do so, how to get started).

*The performance quoted herein represents past performance. Past performance does not guarantee future results. Investors cannot invest directly in an Index and performance represents gross returns without net fees if any.

The opinions expressed are those of HUDSONPOINT capital and not those of Arete Wealth.

Please note that any investment involves risk including loss of principal. This is for informational and educational purposes only and should not be construed as investment advice or an offer or solicitation of any products or services. Opinions are subject to change with market conditions. The views and strategies may not be suitable for all investors and are not intended to be relied on for legal or tax advice.

Securities offered through Arete Wealth Management, LLC, members FINRA and SIPC. Investment advisory services offered through Arete Wealth Advisors, LLC an SEC registered investment advisory firm.