Interested in Alternative Investments?

At HUDSONPOINT capital, we don’t just manage investments — we craft a bespoke strategy centered around you. As your dedicated family office, we align every advisor and handpick opportunities from over 200+ institutional funds to build a diversified portfolio that grows and protect your wealth. By identifying low-correlation alternative investments with high-potential growth opportunities, we aim to unlock exclusive value.

What is Private Equity?

Private equity opportunities enable investors to pool capital and fund private companies in exchange for equity. Unlike traditional public investments, these opportunities provide early-stage access to businesses with high growth potential before they hit public markets.

In other words, for the first time in history, everyday investors can stand shoulder to shoulder with institutions, mutually aligned in their investment goals.

With HUDSONPOINT, retail investors can bypass typical barriers to entry for private equity, such as high capital requirements, and participate in curated PE opportunities. Our transparent, rigorous vetting process helps you navigate this unique asset class with confidence.

Why Invest in Private Equity?

Investing in private equity offers numerous advantages:

- Exclusive Access: Gain entry to innovative private companies in high-growth sectors (traditionally reserved for institutional investors).

- Portfolio Diversification: Design an uncorrelated portfolio by reducing reliance on public markets and investing in privately held companies with unique risk-return profiles.

- Potential for Higher Returns: Aspire for higher returns than traditional equities by capitalizing on early-stage growth.

- Preferred Returns: Take advantage of structured returns, ensuring a minimum threshold of earnings before profits are distributed to others.

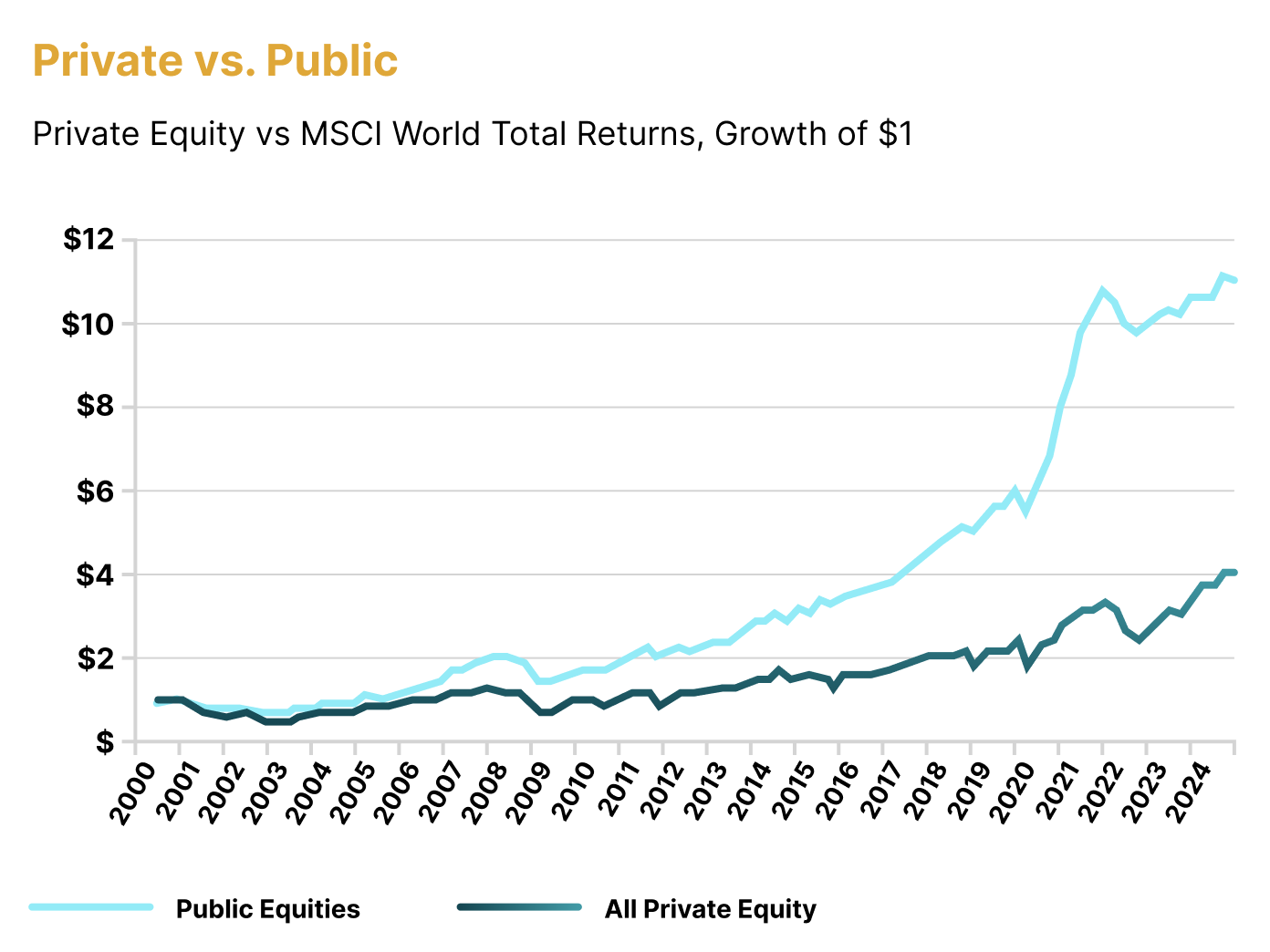

Indeed, for nearly a quarter of a century, private equity returns have consistently outperformed those of public equities, and the performance gap is only widening.

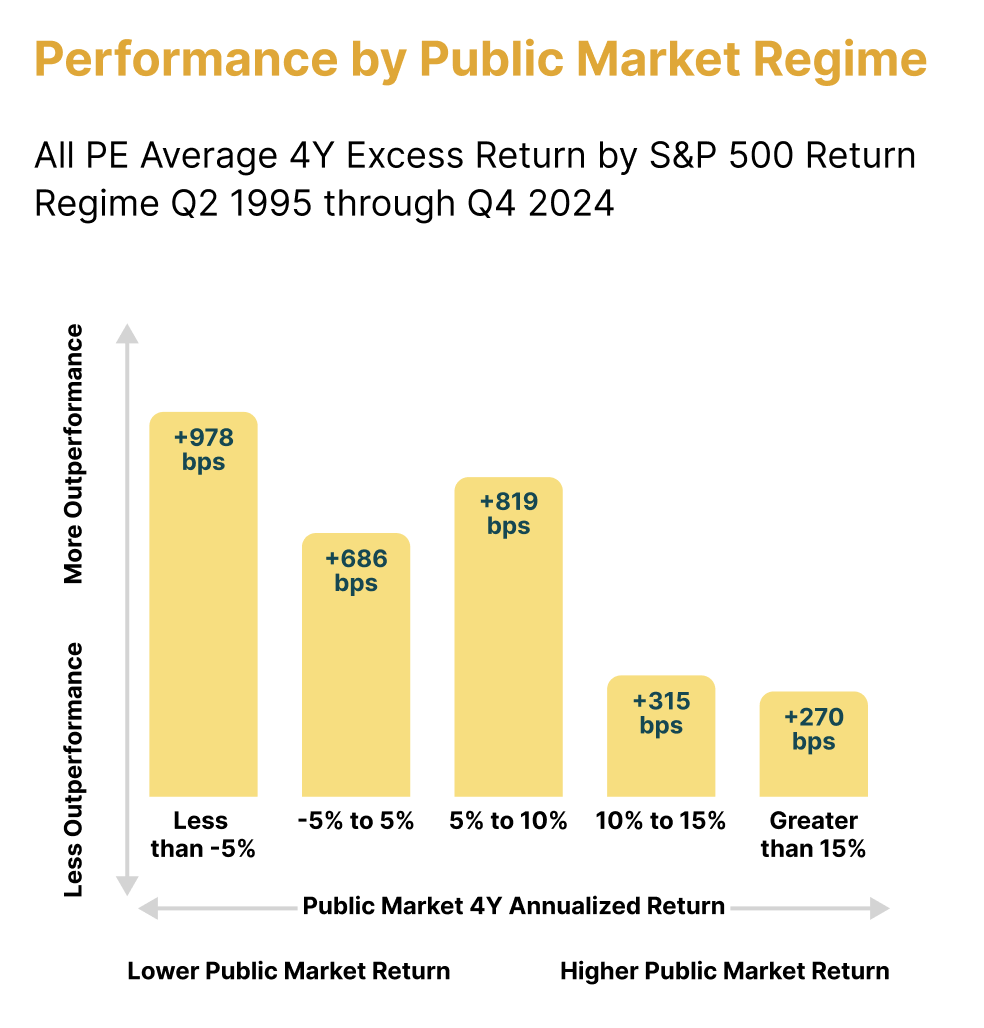

Indeed, private equity investments outperformed the S&P 500 the most during periods of either mediocre or negative equity returns—by as much as 978 basis points (i.e., 9.78%) on average—from Q2 1995 to Q4 2024, according to Cobalt data. Private equity investments also outperformed the S&P 500 even when it returned over 15% annually, by an average of 270 basis points (2.70%).

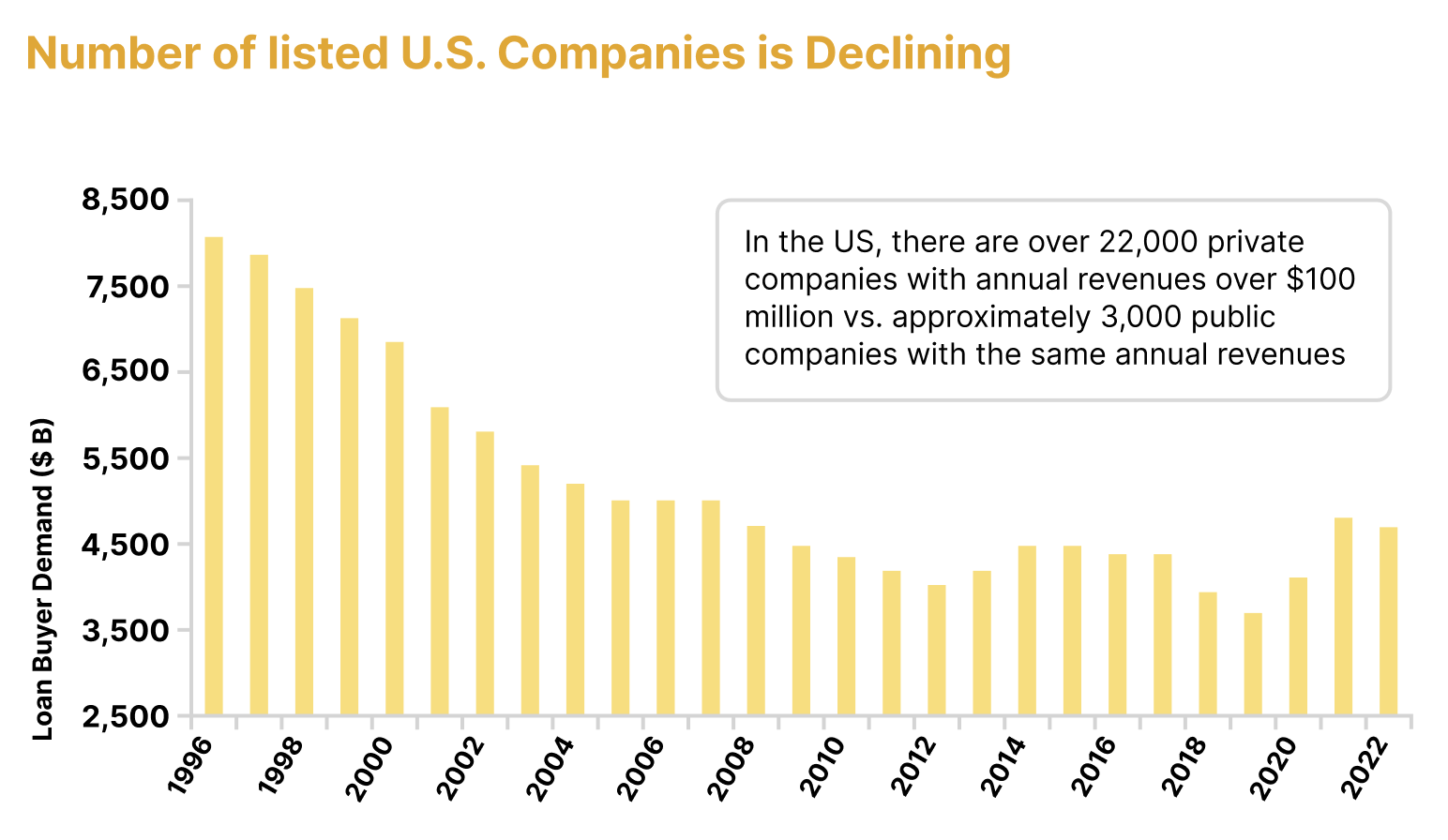

Additionally, the number of publicly listed companies has been steadily declining since the late 90s, with some IPO spikes from 2020–2022. Overall, however, the trend appears to be clear: fewer companies are going public and are opting to remain private instead.

HUDSONPOINT capital's team of professionals will help you discover the world of alternative investments.

How HUDSONPOINT capital Simplifies Private Equity Investing

Once upon a time, private equity investments required significant capital and insider access. HUDSONPOINT capital democratizes this asset class through our streamlined solutions. Here’s how we keep it simple:

- Pooled Capital Model: Our solution aggregates client investments to access high-value private equity opportunities, significantly reducing individual minimums.

- Curated Deals: Every investment is vetted for financial health, growth potential, and alignment with market trends.

- Transparency: From due diligence to distribution, we prioritize clear communication and structured returns.

- Dedicated Support: Our team provides personalized guidance to match investors with opportunities that suit their goals.

With HUDSONPOINT, investors can begin their private equity journey with commitments as low as $100,000. Our emphasis on collaboration ensures that all investors, regardless of their contribution size, gain equal access to what we believe to be high-quality opportunities.

What truly sets us apart is our ability to offer retail investors the same access to exclusive funds that financial institutions enjoy. Through deep relationships with industry leaders such as Apollo, BlackRock, and Blackstone, we offer unique opportunities for growth and diversification.

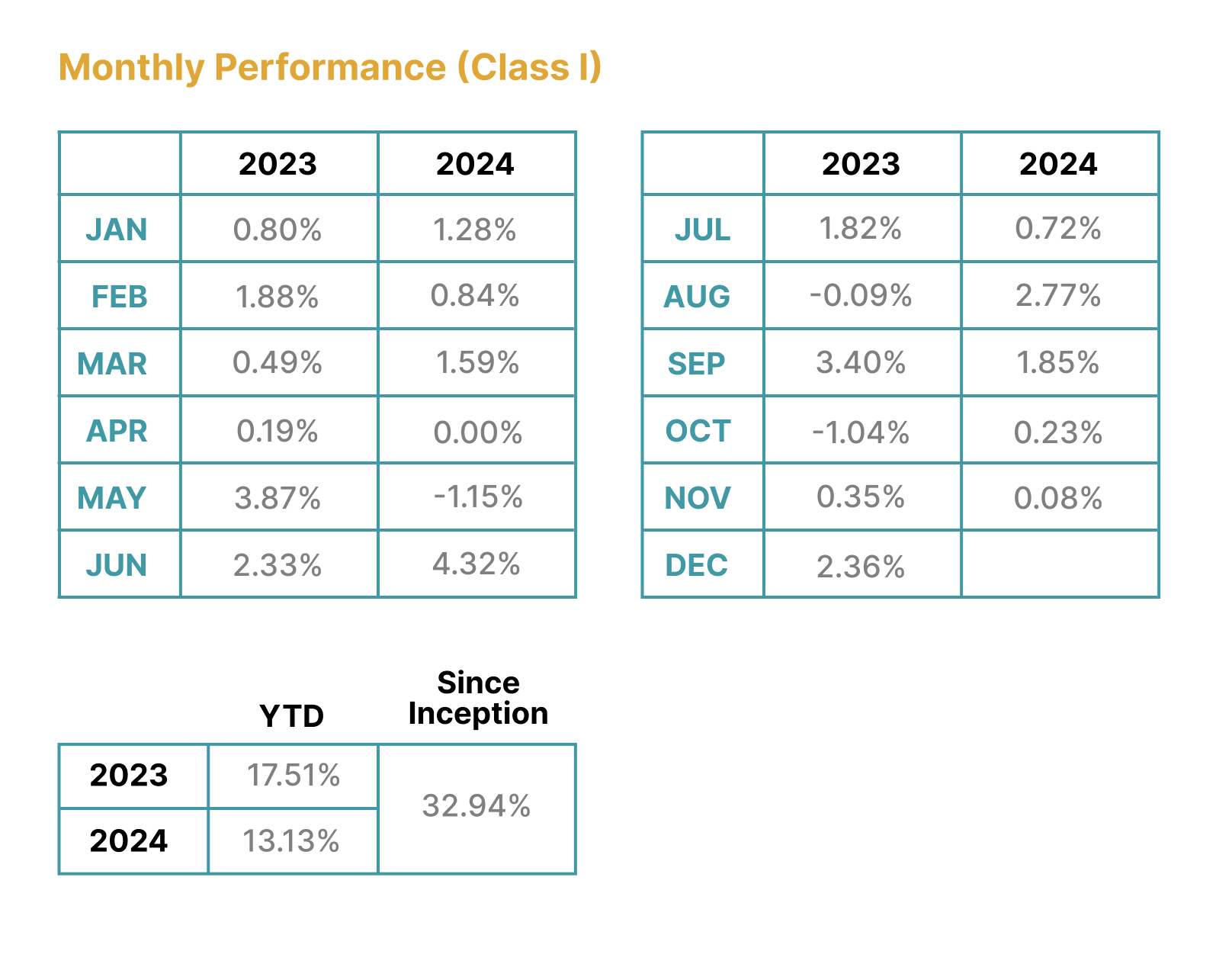

Consider the performance of an unnamed representative private equity fund in our network, which has high exposure to private equity primaries, secondaries, and co-investments. These are all strategies our clients may participate in through our pooled access model.

Examples of Investment Opportunities

At HUDSONPOINT capital, every private equity opportunity is handpicked based on credibility, potential, market position, and alignment with our rigorous standards. We connect investors with a wide range of institutional-quality private equity opportunities; including direct investments, secondaries and diversified fund structures.

We provide access to institutional-level funds that specialize in direct private equity and secondary investments, where the fund’s experienced management team sources, vets, and manages the underlying portfolio of private companies. In addition, we offer exposure to fund-of-funds that invest across multiple private equity managers, giving investors access to a broad range of companies and strategies through a single, professionally managed vehicle.

Direct Co-Investments

Direct co-investments involve investing alongside private equity firms in established companies or projects. These opportunities enable investors to participate in high-value transactions, often involving companies undergoing buyouts, expansions, or growth. Co-investors have the opportunity to participate in the decision-making process, benefiting from the expertise and market insight of the lead equity partner.

This approach offers access to high-growth sectors and potential outsized returns with lower fees compared to traditional fund investments.

Secondary Market Investments

Secondary market investments involve purchasing stakes in private equity funds or individual investments from existing investors, rather than acquiring new investments at the time of the original deal. These investments offer a unique opportunity to enter established funds or companies at a discount, often allowing for quicker liquidity or shorter investment horizons.

Secondary market deals may focus on primary secondaries—investments in portfolios where current investors are selling earlier-stage commitments or holdings—or structured secondaries—where investors buy and sell stakes in private equity funds, providing diversification and enhanced portfolio management.

The Mechanics of Private Equity

HUDSONPOINT capital simplifies the complex world of private equity through a step-by-step process designed for investor success:

- Initial Consultation: Investors meet with our team to discuss financial goals and risk tolerance.

- Opportunity Selection: Our solution presents a curated list of opportunities tailored to the investor’s preferences.

- Investment Execution: Once selected, investments are structured, and funds are pooled alongside other participants.

- Ongoing Management: HUDSONPOINT oversees the investment, providing regular updates and performance reports.

- Exit Strategies: At the appropriate time, investments are liquidated, and returns are distributed to investors.

This comprehensive approach ensures a seamless experience, empowering investors to focus on their long-term financial objectives.

How Private Equity Drives Economic Impact

Investing in private equity is not just a financial decision—it’s a catalyst for broader economic growth.

By channeling resources into startups and mid-sized companies, private equity supports job creation, innovation, and community development. Sectors like renewable energy and healthcare drive advancements that benefit society as a whole.

For example, renewable energy investments contribute to global sustainability goals by funding wind farms, solar power plants, and innovative energy storage solutions. Meanwhile, healthcare investments often lead to breakthroughs in treatment and medical technology, improving quality of life for countless people.

HUDSONPOINT’s strategic focus ensures that your PE investments align with these impactful initiatives.

What Are The Risks Involved With Investing In Private Equity?

While private equity investing offers the potential for attractive returns, it’s important to understand the associated risks.

Illiquidity. Investments in private equity often require a long-term commitment, typically ranging from 3–10 years. Investors need to be comfortable with their funds being tied up for extended periods.

Market and Economic Risks. Private companies are not immune to broader economic downturns or sector-specific challenges, which can impact their performance and profitability.

Execution Risks. Success in private equity often hinges on the management team’s ability to execute their vision. Operational missteps or unforeseen challenges can limit returns.

Valuation Challenges. Unlike public companies, private companies lack transparent market pricing. Valuations are often based on projections, which can lead to discrepancies in perceived versus actual value.

Concentration Risks. Private equity portfolios may be less diversified than traditional investments, increasing reliance on the success of fewer assets.

Regulatory Uncertainty. Changes in regulations or unforeseen legal challenges can affect business operations or exit strategies.

HUDSONPOINT attempts to help mitigate these risks through rigorous due diligence, professional management, and diversification strategies. Our team carefully evaluates every opportunity to ensure it aligns with investor goals while balancing risk and reward.

Take the Next Step

At HUDSONPOINT capital, we offer our clients access to exclusive private equity funds from industry leaders such as Apollo, BlackRock, Blackstone, and Hamilton Lane. These funds execute on a wide range of private equity strategies, including:

- Growth Equity: Investing in companies with high growth potential.

- Venture Capital: Early-stage investments in promising startups.

- Buyout Equity: Acquiring and enhancing control of established businesses.

- Distressed Investing: Turning around financially distressed companies.

- Secondaries: Purchasing stakes in existing private equity funds for quicker liquidity.

- Fund of Funds: Gaining exposure to a diversified portfolio of private equity funds.

By leveraging our relationships and pooled investment model, we offer institutional funds to retail investors, helping you diversify and enhance your portfolio with high-growth opportunities.

Ready to explore private equity investing? Schedule a consultation today.

.jpg)

.jpg)