At HUDSONPOINT our goal is uniquely you. From our holistic wealth management approach that looks at more than just numbers on a statement, to the differentiated and unique alternative investments we provide access to, we feel strongly that we are positioned best for your distinctive goals and needs. By helping quarterback your financial life, coordinating with other professionals from attorneys, accountants, and more, our goal is to make sure your success is most prominent to our journey

Get StartedClick an icon to learn more about the ecosphere.

Through our Financial Planning conversations we help identify opportunities to help create the legacy you want, working with your current Trust and Estate Attorney to implement strategies, or help identity an additional financial/legal professional identify a new professional that suits your life to brainstorm effective methods for generational wealth transfer.

Build Your WealthConversations around current qualified contributions, opportunities, and viewing your portfolio and salary in a holistic manner, we identify opportunities to help you maximize your tax deductions annually. Our investment management is also keenly focused on tax mitigation, tax loss harvesting, and helping you keep more of your hard-earned dollars.

Build Your WealthEveryone’s retirement timeline and goals are different. We work with you to understand what you’re driving towards and how you want to approach your retirement years. Through proper identification of goals and wants, we work with you to provide the right strategy and plan to get there.

Build Your WealthHelping protect you today in order to leave your heirs with a legacy, we work with you on strategies in an effort to protect your assets, investments, and family from the unknowns life throws at you.

Build Your WealthWorking with you to provide Qualified Plans and Financial Planning for employee benefit in order to help you retain top talent at your firm.. Additionally, we help you, the business owner, with ideas and strategies around liquidity, business exit planning, and tax appropriate saving.

Build Your WealthLeveraging our CIO and decades of market experience we provide personalized asset allocations using individual stocks, bonds, and ETFs while ensuring exposure, when appropriate, to unique alternative investments rarely found elsewhere.

Build Your WealthWe start by understanding you, your family and your business. We understand that each individual and family are different and through our initial planning conversations we work with you to identify your priorities. Once we have an initial foundation, we can begin getting to work, continuing the relationship through updates, check-ins, market commentary, and oversight throughout the lifetime of our relationship.

Check out our Learning CenterHUDSONPOINT Capital provides its clients with a holistic planning approach and investment strategies that assist our clients with

managing their short and long-term financial needs. Let us help you devise a clear and concise financial plan with the below steps:

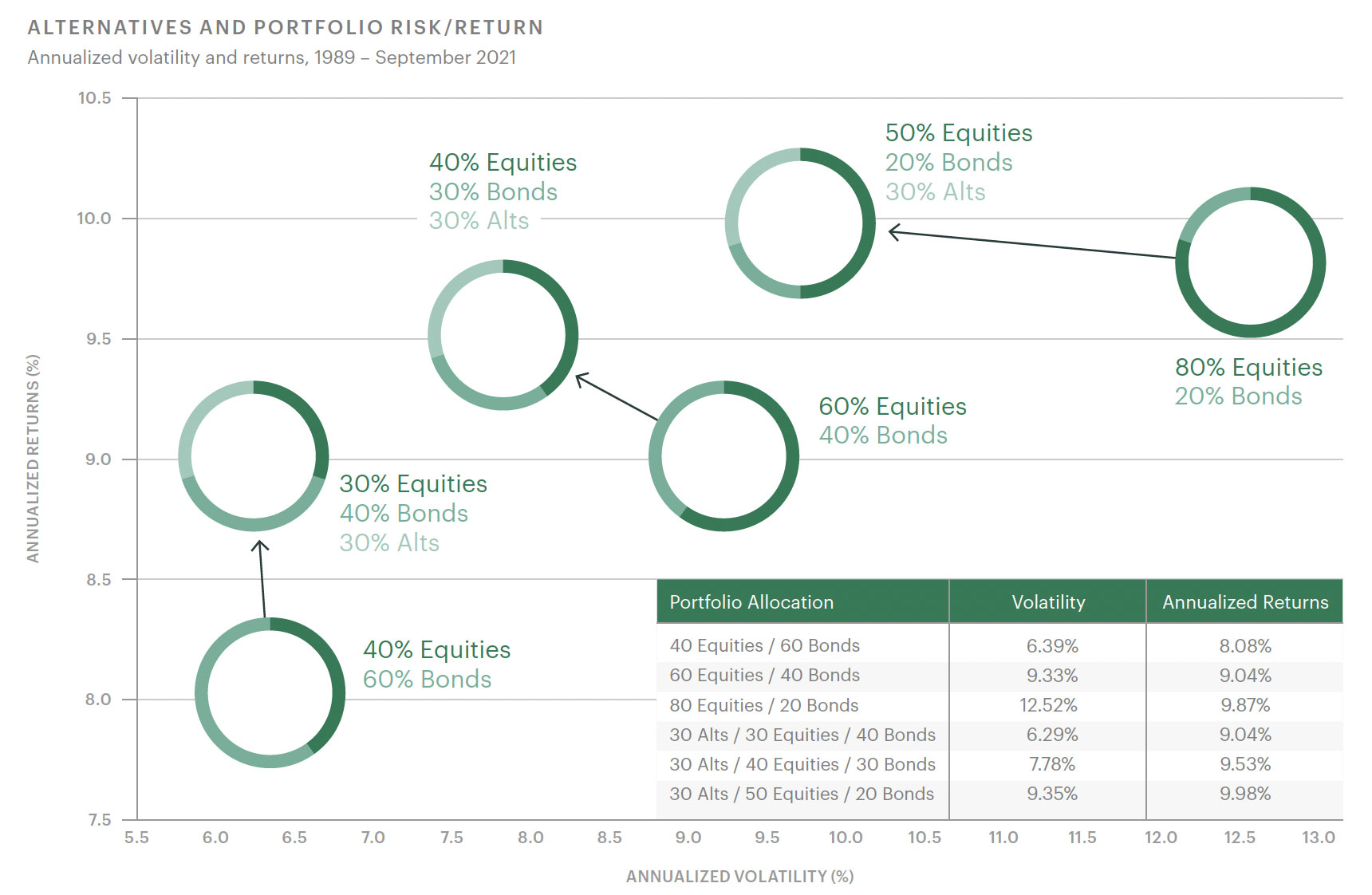

Normal asset allocation strategies used by large wire house advisors and small independent brokers tend to follow the same trend; based on your age and risk tolerance, you may be allocated to a certain percentage of equities and fixed income. Generally, the idea is simple, when stocks go up, fixed income typically underperforms, but when stocks drop, fixed income could provide a ballast to the portfolio. This inverse correlation, overtime, should help mitigate wild swings in your portfolio and allow it to grow over time. What we have seen over the past few years is a breakdown of this thesis. That is why adding alternatives into these “models” and conceptual allocations may work for you.

Alternative Investments cover a wide variety of asset classes, risk profiles, and touch many parts of the economy. When investing in these and partnering with the right managers, an overall asset allocation and portfolio could lead to decreased volatility within someone’s portfolio, but not necessarily decreased returns.

For these reasons and more, we at HUDSONPOINT capital believe in the thesis of adding alternatives to a broader client and family portfolio, for sustained long-term growth possibilities.

Get StartedSource: Bloomberg, Burgiss, HRFI, NCREIF, Standard & Poor's, FactSet, J.P. Morgan Asset Management. Alts include hedge funds, real estate, and private equity, with each receiving an equal weight. Portfolios are rebalanced at the start of the year. Data is based on availability as of February 28, 2022. For illustrative purposes only. No representation is being made by the inclusion of any illustrative portfolio composition presented herein. Past performance is not necessarily indicative of future results.